How Much Does it Cost to Study in Canada in 2025?

Each year, thousands of ambitious Nepali students choose Canada as their gateway to world-class education and global career opportunities. With its prestigious universities, welcoming multicultural environment, and excellent post-graduation prospects, Canada has emerged as a premier study destination for international students.

However, understanding the financial commitment is crucial before marching on this educational journey. The total cost to study in Canada from Nepal includes your tuition fees, living expenses, travel costs, and various additional expenses that can significantly impact your budget planning.

Understanding the varied expenses of studying in Canada from Nepal will help you make informed financial decisions and plan effectively for your educational investment.

In this blog

Why Choose Canada for Higher Studies?

Canada offers a world-class education system with degrees recognized internationally, with universities focusing on your practical learning through internships and co-op programs. As a student in Canada, you benefit from:

- Research projects using modern labs and technology.

- Part-time work during school and full-time during breaks.

- Post-Graduation Work Permit (PGWP) to gain work experience in Canada.

- Permanent residency opportunities for skilled international graduates.

- Student safety and security for your peace of mind while living there.

- Multicultural communities with a welcoming attitude.

- High-quality living with good healthcare, infrastructure, and overall comfort.

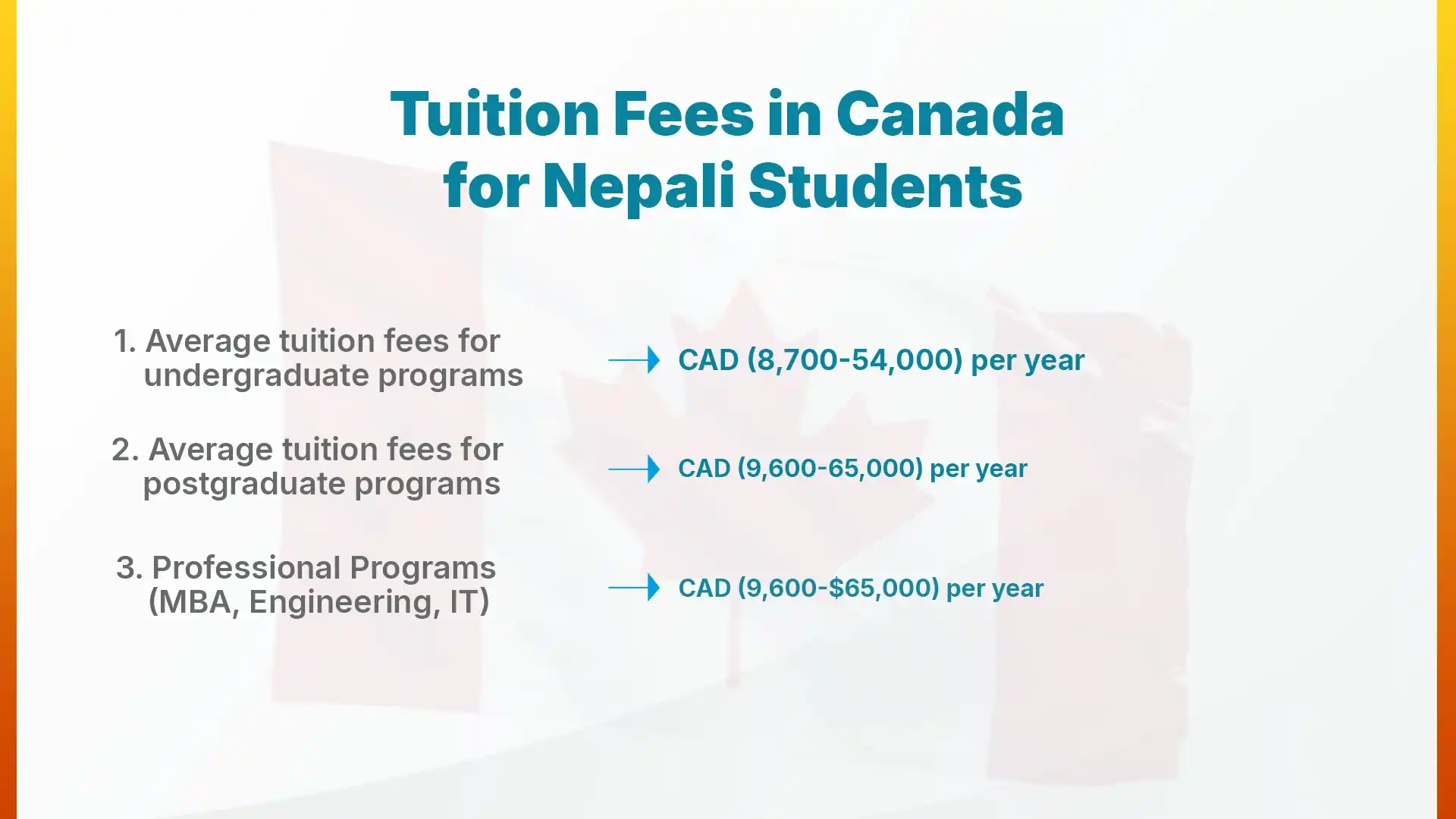

Tuition Fees in Canada for Nepali Students

Undergraduate programs range from CAD 8,700–54,000 per year, while postgraduate and professional programs range from CAD 9,600–65,000 per year. Tuition fees for Nepali students vary depending on the chosen program, university, and field of study. The cost is higher for programs like MBA, Engineering, or Medicine. Arts and Humanities programs cost relatively less.

1. Undergraduate Programs

The average tuition fees for undergraduate programs in Canada range from CAD 12,000 to 25,000 per year for international students. Arts and Humanities Programs are generally the most affordable option, while STEM programs command higher fees due to laboratory requirements and specialized equipment.

Program Type | Average Tuition per Year | Notes |

| Arts & Humanities | CAD 8,700–25,000 | Literature, history, philosophy, social sciences |

| STEM Fields | CAD 15,000–40,000 | Science, Technology, Engineering, Mathematics includes lab and equipment costs |

2. Postgraduate Programs

On average, Master’s degrees cost CAD 9,600–35,000 per year, while graduate diplomas are slightly lower, and research programs may offer funding. Postgraduate programs provide advanced learning and research opportunities.

Program Type | Average Tuition per Year | Notes |

| Master’s Degrees | CAD 9,600–35,000 | Thesis-based programs often cost less than course-based programs |

| Graduate Diplomas | CAD 12,000–25,000 | Career-focused programs with faster employment pathways |

| Research Programs (PhD) | Varies (with funding) | Funding through assistantships or scholarships can reduce net cost |

3. Professional Programs

Professional programs are specialized and often come with higher tuition due to their career impact. Average costs are higher for MBA, Engineering, and Healthcare programs.

Program Type | Average Tuition per Year | Notes |

| MBA Programs | CAD 30,000–65,000 | Executive programs may exceed these amounts |

| Engineering Specializations | CAD 20,000–45,000 | High-demand fields like software or petroleum engineering |

| Healthcare Programs | CAD 50,000+ | Medical, dental, veterinary programs; strong career prospects |

How Much Does It Cost to Live in Canada While Studying?

Monthly living expenses in Canada typically range from CAD 1,200 to 3,000 per month for international students. This includes your total monthly budget for accommodation, food, transport, utilities, and insurance. The annual cost is roughly CAD 14,000 to 32,000, depending on the city and lifestyle.

Your lifestyle choices and city selection significantly impact living expenses, which can equal or exceed tuition costs depending on your circumstances.

1. Accommodation Options

Housing represents your largest monthly expense, with costs varying dramatically from CAD 800–1,800 based on your location and rent type:

On-Campus Housing

University residences offer convenience and community but typically cost CAD 800 to 1,800 monthly. These facilities often include meal plans, utilities, and proximity to campus resources.

Shared Accommodation

The most economical option for many students is shared apartments or houses cost CAD 600 to 1,200 monthly per person. This option provides independence while controlling costs through shared utilities and rent.

Private Rentals

One-bedroom apartments in major cities like Toronto or Vancouver can cost CAD 1,500 to 2,500 monthly, while smaller cities might offer similar accommodation for CAD 800 to 1,300.

Homestay Programs

Living with Canadian families costs CAD 700 to 1,000 monthly and includes meals, utilities, and cultural immersion opportunities that can ease your transition to Canadian life.

2. Daily Living Expenses

Budget around CAD 1,255–3,300 per month for your day-to-day life expenses. These will be your major expenditures in Canada:

Food and Groceries

Cooking at home costs approximately CAD 250 to 400 monthly for groceries, while frequent dining out can easily double this amount. Shopping at discount stores and buying in bulk can reduce food costs significantly.

Transportation

Public transit passes cost CAD 80 to 150 monthly, depending on the city. Many universities offer discounted student passes, and some cities provide free campus shuttle services.

Utilities and Communications

Internet, mobile phone plans, electricity, and heating typically cost CAD 100 to 200 monthly, though some rentals include utilities in the base rent price.

3. Health Insurance and Medical Costs

Healthcare insurance in Canada will cost you anywhere between CAD 600 and 1,500. It is mandatory for all international students, including those from Nepal. The insurance covers your medical check-ups and prescriptions. You have the following options for your health insurance:

Provincial Health Insurance

Some provinces offer coverage to international students after a waiting period, typically costing CAD 600 to 1,200 annually.

University Health Plans

Institutions often require enrollment in comprehensive health insurance plans costing CAD 800 to 1,500 per academic year.

Additional Coverage

Dental, vision, and prescription drug coverage may require supplementary insurance, adding CAD 300 to 600 annually to your costs.

Monthly Living Cost Breakdown for Students in Canada

Expense Category | Lower Range (Monthly) | Higher Range (Monthly) | Annual Estimate |

| Accommodation | CAD 600 | CAD 2,000 | CAD 7,200 – 24,000 |

| Food & Groceries | CAD 250 | CAD 500 | CAD 3,000 – 6,000 |

| Transportation | CAD 80 | CAD 150 | CAD 960 – 1,800 |

| Utilities & Internet | CAD 100 | CAD 200 | CAD 1,200 – 2,400 |

| Health Insurance | CAD 75 | CAD 150 | CAD 900 – 1,800 |

| Personal Expenses | CAD 150 | CAD 300 | CAD 1,800 – 3,600 |

| Total Monthly | CAD 1,255 | CAD 3,300 | CAD 15,060 – 39,600 |

Additional Expenses for Canadian Education

Beyond tuition and living expenses, you may need to budget some extra thousand dollars for several one-time additional costs like visa application, flight fares, and personal supplies.

1. Student Visa and Immigration Fees

For your visa, Canadian immigration requires several mandatory payments:

Fee Type | Typical Cost Range (CAD) |

| Study Permit Application | CAD 150 |

| Biometric Services | CAD 85 per person; CAD 170 family max |

| Medical Examination | CAD 150–220 |

| Document Translation/Authentication | CAD 50–100 per page (translation); CAD 100–300 (authentication) |

2. Travel and Transportation Costs

Round-trip flights from Kathmandu to major Canadian cities typically cost around CAD 1,200 to 2,000. The prices significantly vary by season, booking timing, and airline choice. Additional luggage costs can add CAD 200 to 500 to your travel expenses, especially when bringing essential items from Nepal.

3. Academic and Personal Supplies

On average, textbooks, course materials, technology, and personal items can add a few thousand dollars to your yearly budget. Planning for these expenses early helps you avoid surprises and manage your finances effectively.

Item | Average Cost | Notes / Tips |

| Textbooks & Course Materials | CAD $800–$2,000 per year | Save by buying used books, renting, or using digital versions |

| Technology Requirements | CAD $1,500–$3,000 | Includes laptop, software licenses, and specialized equipment for some programs |

| Personal Items & Clothing | CAD $300–$800 | Winter clothing is essential; quality items last multiple seasons |

4. Emergency Fund Recommendations

Having an emergency fund is crucial to handle unexpected costs like medical emergencies, travel, or temporary income gaps. Experts suggest setting aside at least 3–6 months of living expenses. Always have your bank account filled with this fund to avoid any crisis. Plan any of the following funds:

Fund Type | Recommended Amount | Purpose |

| Minimum Emergency Fund | CAD $3,000–$5,000 | Covers basic emergencies and unexpected expenses |

| Comprehensive Emergency Fund | CAD $8,000–$12,000 | Provides extra security and flexibility for major unexpected events or opportunities |

Scholarship and Financial Aid Opportunities

Nepali students can access scholarships from the Canadian government, universities, and private organizations. These include merit-based awards, need-based grants, and funding for specific programs or fields of study. Scholarships and financial aid dramatically reduce your educational costs, relieving your financial burden while you study in Canada as a Nepali student.

1. Canadian Government-Sponsored Scholarships

Canadian federal and provincial governments offer various funding opportunities:

- Vanier Canada Graduate Scholarships: Prestigious awards worth CAD 50,000 annually for PhD students, recognizing academic excellence, research potential, and leadership skills.

- Ontario Graduate Scholarship (OGS): Provincial program offering CAD 10,000 to 15,000 annually for graduate students in Ontario universities.

- Quebec Merit Scholarship: The Quebec government provides funding for international students in priority areas, offering CAD 25,000 to 35,000 annually.

2. University-Specific Financial Aid for International Students

Most Canadian institutions also offer comprehensive scholarship programs:

- Entrance Scholarships: Merit-based awards for new students with outstanding academic records, typically ranging from CAD 1,000 to 10,000 annually.

- International Student Awards: Specifically designed for international students, these scholarships can cover partial or full tuition costs based on academic performance and financial need.

- Work-Study Programs: On-campus employment opportunities that provide both income and valuable work experience, typically paying CAD 15 to 25 per hour.

3. Organisation-funded Scholarships in Canada

External funding sources can supplement government and university aid:

- Professional Association Scholarships: Industry organizations often provide funding for students in specific fields, particularly engineering, business, and healthcare.

- Cultural and Community Organizations: Nepali-Canadian organizations and cultural associations sometimes offer scholarships and mentorship programs for Nepali students.

- Corporate Sponsorships: Some multinational companies provide educational funding in exchange for internship commitments or future employment considerations.

Total Cost to Study in Canada from Nepal

For a Nepali undergraduate student, the total yearly cost, including tuition and living expenses, ranges from CAD 22,700 to 82,000, while for postgraduate or professional programs’ students, the total cost can reach CAD 23,600 to 93,000 per year. The final cost depends on the program, city, duration of your study, and lifestyle choices.

1. Approximate Yearly Cost including Tuition and Living Expenses

Study Level | Tuition Range | Living + Additional Costs | Total Annual Cost |

| Undergraduate | CAD 8,700 – 54,000 | CAD 15,000 – 30,000 | CAD 23,700 – 84,000 |

| Postgraduate | CAD 9,600 – 65,000 | CAD 15,000 – 30,000 | CAD 24,600 – 95,000 |

| Professional Programs | CAD 15,000 – 65,000 | CAD 15,000 – 35,000 | CAD 30,000 – 100,000 |

2. Total Average Tuition Based on Program Duration

The duration of your program largely affects the total budget for your Canadian study.

Program Type | Duration | Total Cost (CAD) |

| Undergraduate Program | 4 years | 95,000 - 336,000 |

| Master's Program | 2 years | 50,000 - 190,000 |

| Graduate Diploma | 1 year | 25,000 - 50,000 |

Tips to Manage Expenses While Studying in Canada

Students can save money by working part-time, choosing affordable housing, cooking at home, and using student discounts. Applying for scholarships early and keeping a monthly budget also helps reduce financial stress.

1. Employment and Income from Part-Time Jobs

Maximizing work opportunities while maintaining academic focus for a side income. Your part-time jobs will completely cover your living expenses. If you manage to save a certain amount every month, you may even be able to pay some of your tuition fees. Your job options as a Nepali student in Canada include:

- On-Campus Jobs: Working in libraries, labs, or offices can provide you with around CAD 15–25 per hour with flexible schedules.

- Co-op Programs: Finding positions and working in your academic field can help you earn around CAD 3,000–6,000 per month while gaining work experience.

Freelancing or Remote Work: Use skills like writing, tutoring, graphic design, or programming to make extra money.

2. Make Smart Lifestyle Choices

Choose smaller cities or suburban areas to reduce living costs compared to major cities like Toronto or Vancouver. Share housing with other students to lower rent and build a supportive social network. Plan meals and cook at home to cut food expenses by 40–60% instead of relying on dining out or buying prepared meals.

3. Reduce Academic Costs

Use library resources, digital versions, or second-hand textbooks to save 50–70% on learning materials. Take heavier course loads or summer classes to complete your program faster and reduce total tuition costs. Consider transferring credits from previous studies to skip courses if possible. This shortens your program and lowers both tuition and living expenses.

4. Costs Vary by City

Where you study in Canada makes a big difference in living costs. Major cities automatically cost more, but are filled with growth opportunities. Smaller cities come with affordable expenses and a similar quality of education. You may feel a difference in vibrance and lifestyle in different locations, but each Canadian city has something of its own to offer all its residents.

Major Canadian Cities

- Toronto (GTA): Lots of opportunities, but living costs are 20–40% higher than average.

- Vancouver: Beautiful city with mild weather, but expensive housing.

- Montreal: Good education, moderate costs, and a unique French-Canadian culture.

Mid-Sized Canadian Cities

- Calgary: Affordable living with a strong economy and job opportunities.

- Ottawa: Government internships and moderate costs.

- Halifax: Low living costs and a strong university community, but fewer jobs.

Smaller University Towns in Canada

- Waterloo: Technology hub with co-op programs and reasonable costs.

- Kingston: Historic city, affordable housing, and a close-knit academic community.

- Saskatoon: Very low living costs and a growing job market in agriculture and mining.

5. Financial Planning Timeline and Preparation

Planning your finances early makes studying in Canada much easier. Start 12–18 months before your study start date to avoid last-minute stress.

18–12 Months Before Departure

- Check Your Finances: Calculate how much your family can afford and identify any gaps that need scholarships, loans, or extra savings.

- Apply for Scholarships: Start searching and applying early since many scholarships have early deadlines.

- Start Saving: Open a dedicated savings account for your Canada studies and set up a regular savings schedule.

12–6 Months Before Departure

- Submit University Applications: Apply to your chosen programs and check their costs and financial aid options.

- Apply for Loans: If needed, start education loan applications early, as approval can take time.

- Refine Budget: Adjust cost estimates based on the universities and cities you’ve selected.

6–0 Months Before Departure

- Finalize Finances: Confirm all funding sources, complete loan processes, and arrange foreign exchange.

- Plan Pre-Arrival Expenses: Budget for visa fees, medical exams, travel insurance, and initial settlement costs.

- Prepare an Emergency Fund: Keep extra funds accessible for any unexpected expenses after you arrive.

Conclusion

Beyond the tuition fees and living expenses, studying in Canada is more of a financial investment that provides you with an ocean of opportunities. It is a chance to shape your future, gain a world-class education, and experience life in a safe, welcoming environment.

Remember that the costs are huge, but so are the prospects. Careful planning, early scholarship applications, and smart budgeting can make this journey to a brighter future a lot more achievable for rightly motivated Nepali students.

Proper discipline, wise lifestyle choices, and strategic planning are all you need. Start preparing today, explore scholarships, and map out your budget. Be assured of your plan. Do not hesitate to reach out to an educational and visa consultant.

Looking for the best consultancy in Nepal? Choose SAS Education Consultancy for expert guidance and proven success. If you are already searching for trusted support, Contact Us Today!